Northeast property inspections begin

Cost savings to city and less appeals expected

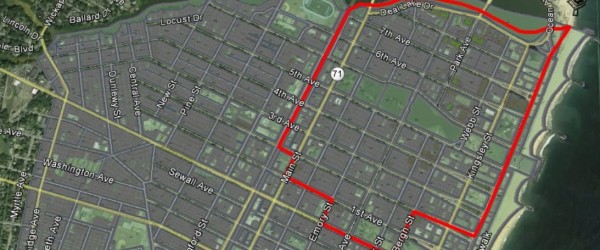

Next week property owners in the northeast corner of Asbury Park will receive inspection notices.

The notices are part of a new policy to conduct property inspections in different sections of the city once every five years as opposed to waiting for the more costly and less accurate city-wide revaluations, and their associated inspections, that could take place once a decade.

Under the new program, every property in the municipality will be reassessed annually for the purpose of setting the property tax. As a result, property values will be adjusted to reflect current market conditions. The physical inspections that will take place every year in parts of the city will collect the data to use for that city-wide adjustment.

The shift is due to a an Assessment Demonstration Program [ADP] Gov. Chris Christie signed into law in 2013.

Asbury Park saw a 66 percent cost decrease and a 36 percent drop in appeals last year, city tax assessor Erick Aguiar said. Monmouth County is the first county opt into the new program.

“These are big numbers we are talking about,” he said.

The inspections in northeast Asbury will be conducted by Realty Data Systems and should take a couple months to complete, Aguiar said.

The city’s last revaluation cost $265,000 and spurred 220 tax appeals. The costs of the inspections under the new program will be $90,000 over 5 years, Aguiar said. Appeals have already been reduced, with 140 appeals this year, he said.

Prior to the ADP reforms, revaluations were conducted every 5 to 10 years. Asbury Park’s 2002 revaluation remained in effect until 2013, leaving a distortion of property values for tax purposes throughout the city, as different sections of the city saw different changes in their values. The decade saw a resurgence of businesses along Cookman Avenue and the downtown area as well as a recession that sparked mass foreclosures and declining property values.

“This was a big problem for a city as diverse as Asbury Park,” Aguiar said. “There were a lot of changes that occurred during that time.”

The once boarded-up storefronts had now reopened for business but the remainder of the community was still picking up their tax burden, he said.

“Basically, the southwest was subsidizing the rest of the city since their value didn’t appreciate as much as other areas,”Aguiar said.

Now property reassessments will be done annually with 1/5th of the city’s 4,500 properties inspected each year.

Another benefit is the switch from the April tax appeal season to a January deadline, Aguiar said. Now tax appeals will be completed by budget season creating a more accuarate tax rate.

Any questions should be directed to the tax assessor office at (732) 502-5750

———————————-

Follow the Asbury Park Sun on Facebook, Twitter and Instagram.